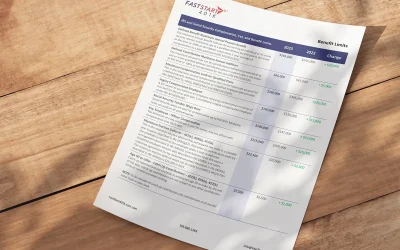

Benefit limits have been updated for 2025 and there have been significant changes. The annual benefit limits are updated each October for the coming...

401(k) Plan Articles

Unlock Your Tax Credits: SECURE Act 2.0

As of tax year 2023, SECURE Act 2.0 provides generous tax credits to small companies who start qualified retirement plans. Here’s what YOUR company may qualify for!

Why Adopt a Company 401(k) Plan Instead of My State’s IRA Program?

There are many reasons why a business should adopt a 401(k) Plan instead of a state-administered IRA...

What is a Safe Harbor 401(k) Plan?

Safe harbor 401(k) plans are the most popular type of 401(k) sponsored by small businesses today. A...

What are ADP and ACP Tests?

The IRS requires that sponsors of 401(k) plans must test annually to make sure the plan isn’t unfairly discriminating against Non-Highly Compensated...

What is a Top-Heavy 401(k) Plan?

A 401(k) plan is considered top-heavy when the owners and key employees own more than 60% of the total value of the plan assets. The ratio is...