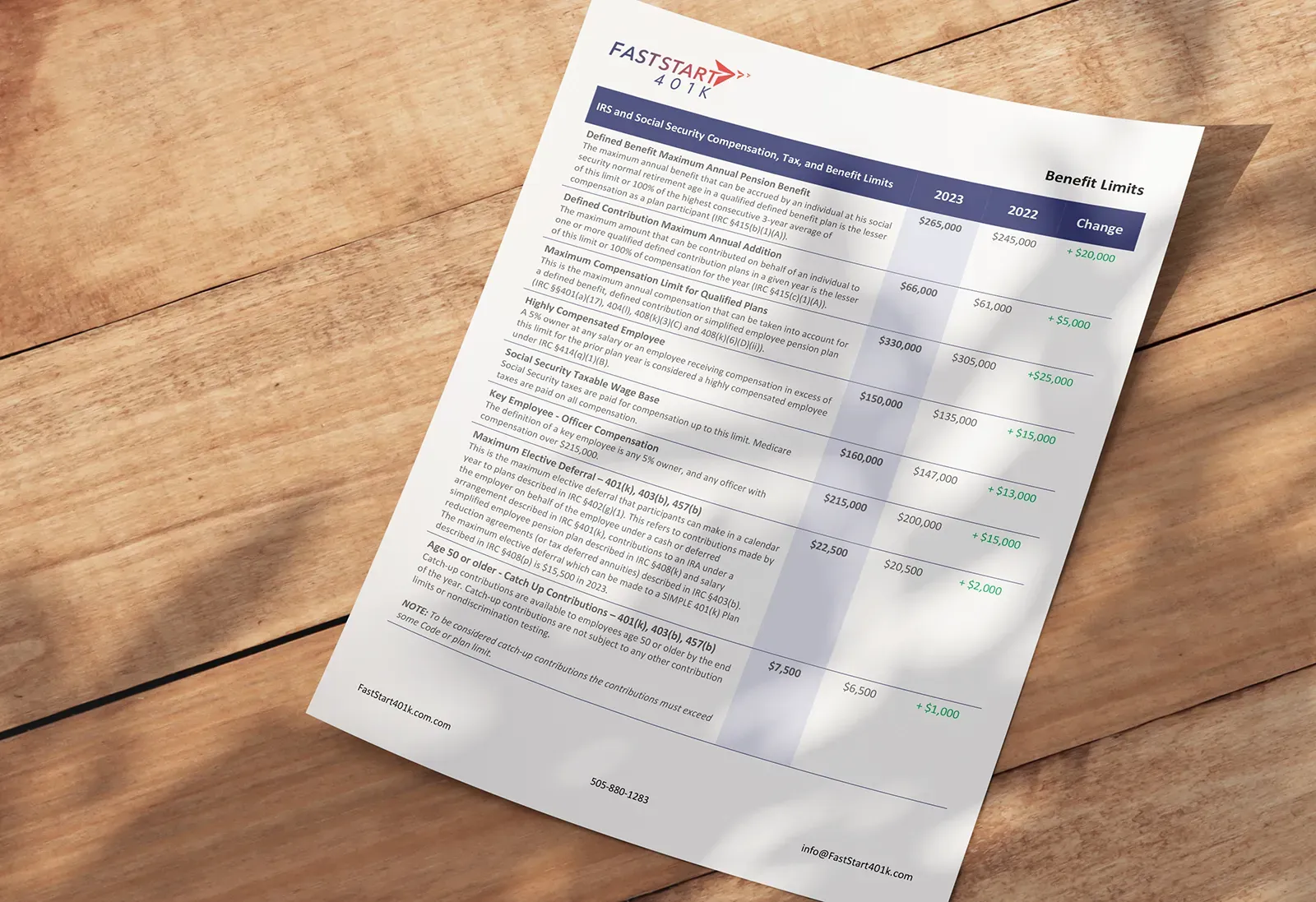

Benefit limits have been updated for 2025 and there have been significant changes.

The annual benefit limits are updated each October for the coming year. These limits impact, among other things, the maximum amount you can contribute to your qualified 401(k) plan.

401(k) Plan Specific Limits

Maximum Contribution: $23,500

This is the maximum amount a participant can defer into a 401(k) plan in 2025, unless the participant is age 50 or older.

Catch Up Contribution: $7,500

Participants in a 401(k) plan who are age 50 or older may make an additional maximum contribution of $7,500 in 2025. Participants age 50 or older can contribute a maximum of $31,000 in 2025 (subject to some limitations).