Team Builder Retirement Plan

This 401(k) Plan is designed business owners who DO NOT want to participate in the plan, but need to meet state requirements for all employees.

Team Builder Retirement Plan

This 401(k) Plan is designed for business owners who DO NOT want to participate in the plan, but need to meet state requirements for all employees.

Details

Clear Pricing:

| Now: | $250 one-time setup fee |

| Monthly: | $89 plan administration fee + $8 per active participant + $84 recordkeeping fee (until plan assets reach $220,000) |

Setup fee is non-refundable.

Fees shown here apply to NEW PLANS ONLY. If you have a current plan, other fees may apply.

Contact us if you have questions. See all fee info below.

What Happens After I Sign Up?

After completing your purchase, an email will be sent to the address you provide with links to download the following files.

A Welcome Letter

Detailed information about your plan, the setup process, essential contact information for our team, and more

Employee Census Worksheet

Fill this out and send it back to us to get the ball rolling!

New Client Implementation Worksheet

Fill this out and send it back to us to get the ball rolling!

Implementation Timeline

A simple illustration of the next steps you can expect in our setup process

Key Plan Features

Eligibility to Use the Plan

- Designed for employees only; you (the employer) don’t participate

- Some highly-compensated employees may not participate

- Designed for small businesses with less than 100 employees

- Requirements that employees must meet before they can benefit from your company’s retirement plan are set for you. This makes it easy to know when they can begin to benefit from this retirement plan.

Putting Savings into Retirement Accounts

- You (the employer) don’t have to contribute anything to participant accounts

- Savers can choose between paying taxes on the income they defer into retirement accounts either now (Roth) or after you retire (Traditional)

Withdrawing or Borrowing from Your Retirement Account

- You’ll still have access to your funds in case of financial hardship (medical bills, natural disaster damage, etc.), following standard rules

- Option to withdraw funds once savers reach age 59 1/2, based on standard rules

- Normal retirement age is 65, following standard guidelines

- Option to take a loan from your retirement savings, following standard rules

Online Tools

- Convenient online enrollment process

- Participants can access to their retirement accounts 24/7 through an online platform provided by your plan’s Recordkeeper

Plan Administration and Management

- Form 5500, a required document, will be signed by a 3(16) fiduciary on your behalf

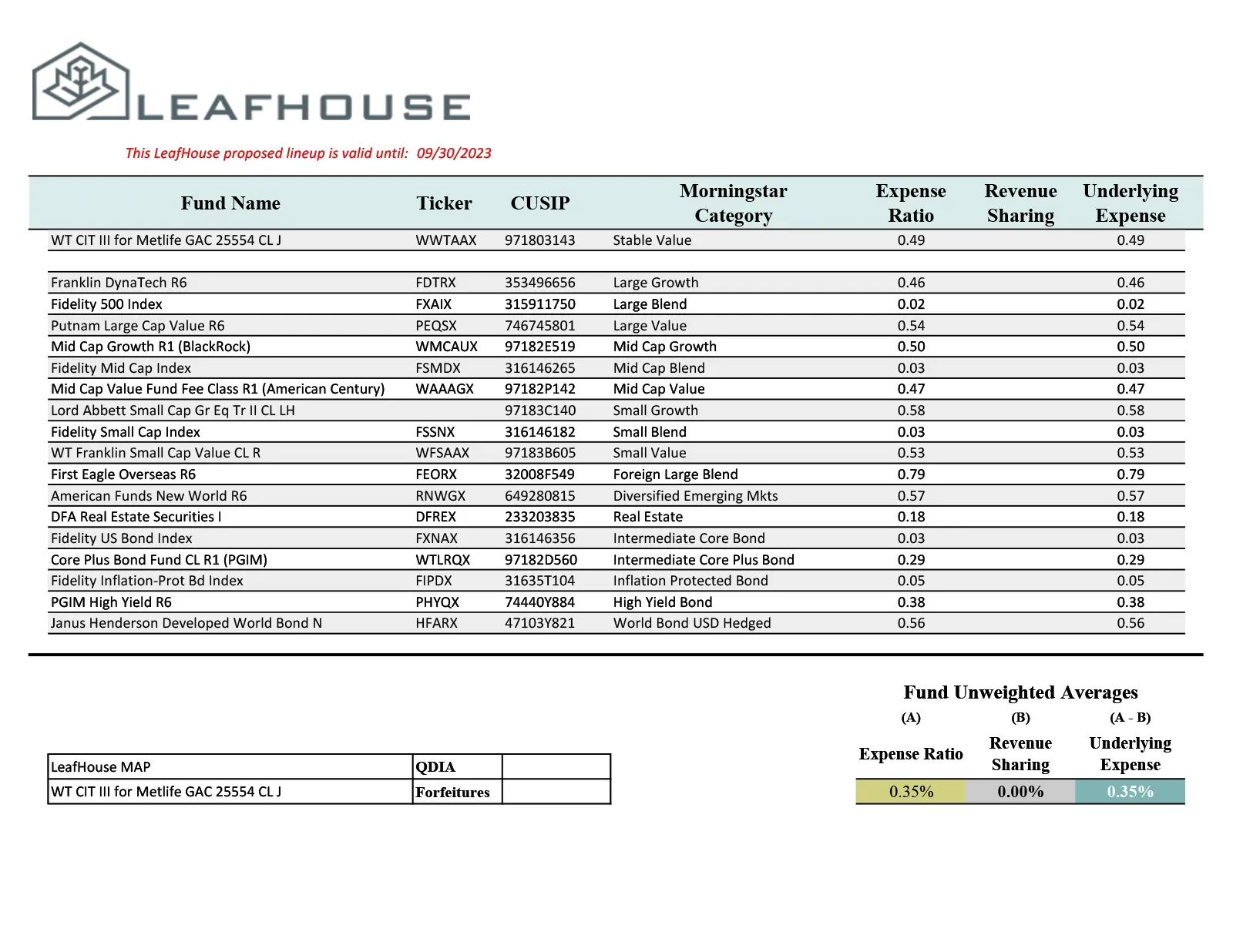

- Your investment lineup will be provided by a trusted investment representative (a 3(38) fiduciary)

- No need for complicated IRS testing, thanks to contribution limitations

All Fee Info

- Administration Services

Initial Setup Fee: $250 (non-refundable after purchase)

Plan Administration Fee: $89 monthly

Recordkeeping Fee: $250 quarterly, invoiced by KTRADE (only until plan assets reach $220,000)

Per Participant Fee: $8 monthly, deducted from Participant’s Account - Additional Fees

Participant Distributions: $125 each

Participant Loans: $225 each